With bets for bullish ANKR price prediction outcomes restored, the bulls have initiated a comeback in the ANKR/USDT pair after a recent relentless onslaught by the bears.

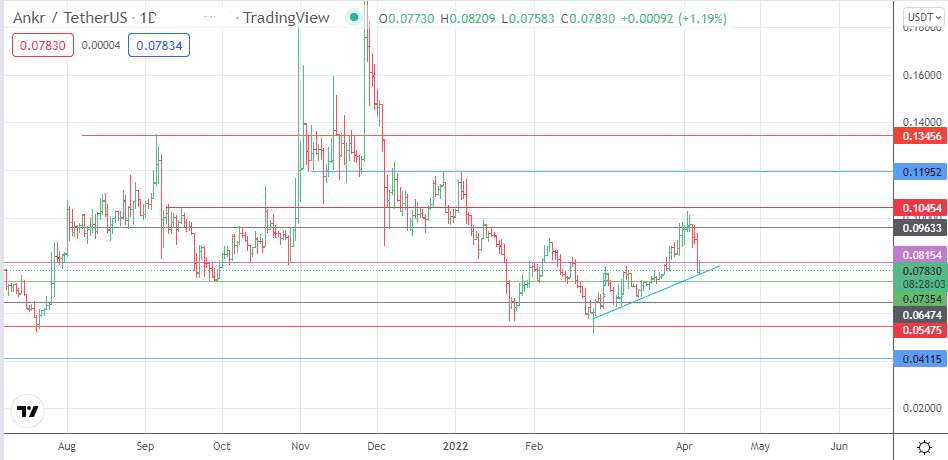

The ANKR/USDT pair lost 15.74% yesterday after selling in the crypto market accelerated towards the end of the trading day. This selloff violated the 0.08154 support but failed to knock off the ascending trendline that connects the most recent lows seen from 24 February to date. The trend’s intraday bounce could still fail to translate to bullish action if the 0.08154 resistance arrests the uptick.

The renewed upside move comes as crypto market enthusiasts digest the project’s launch of a new blockchain gaming SDK. The new ANKR software development kit will enable gaming studios to enhance the Web3.0 capabilities of their various gaming portfolios. In addition, the SDK will also allow gaming studios to mint their digital files into NFTs.

ANKR has also been busy on other fronts. It was one of three blockchain projects that launched a Binance Smart Chain Application Sidechain testnet. ANKR was identified by Binance as one of three projects to implement the testnet, in accordance with its 2022 BNB Chain roadmap. BAS is a next-gen blockchain infrastructure that will enable developers work on large-scale applications based on the Binance Smart Chain. The ANKR/USDT pair is up 2.78% as of writing.

ANKR Price Prediction

If the bulls succeed in taking out the resistance at the 0.08154 mark following today’s test, the next target will come in at the 15 September/19 October 2021 lows at 0.10454. Above this level, additional price barriers will feature 0.11952 (27 December 2021/3 January 2022 lows) and 0.13456. The recovery move continues once the price advances beyond the 0.10454 resistance level.

On the flip side, there is also the potential for the price candle to face rejection at the current resistance level. In this scenario, the pullback would initially test the 0.07354 support level (3 February and 20 March lows) before the 0.06474 pivot enters the picture as an additional target to the downside. Finally, 0.05475 (21 July 2021 low) and 0.04115 round off the additional target to the south in the short term.

ANKR/USDT: Daily Chart