INTRODUCTION

There’s no doubt that digital currencies have grown tremendously. As a result of the phenomenal growth of bitcoin (BTC) and ether (ETH), the cryptocurrencies field has continued to grow. There are many digital currency enthusiasts who believe that these investments could lead to the creation of a new batch of digital currency millionaires or billionaires. As well as initial coin offerings (ICOs), many new types of blockchain investment products are emerging, including those from decentralized finance company ANKR. The Motley Fool’s Chris MacDonald considers the reasons to buy Ankr below.

Cloud computing is a hyper-growth sector that Ankr is looking to disrupt.

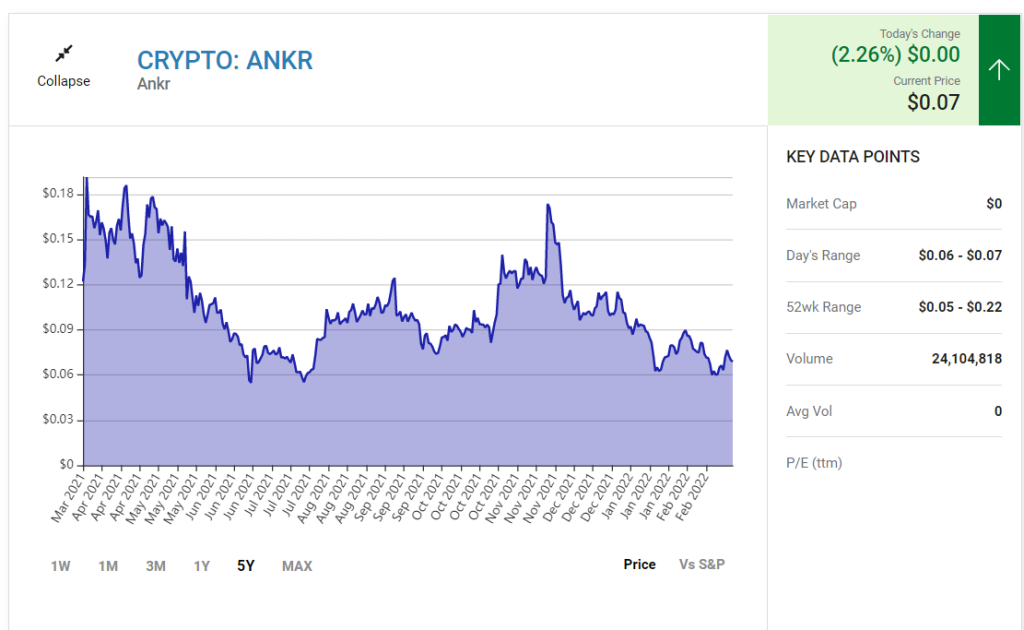

For cryptocurrency investors thinking long term, Ankr ( ANKR 2.26% ) may be one of the best crypto plays in the market right now. An emerging force in decentralized finance (DeFi), Ankr has been making some serious gains lately. In fact, ANKR is up about 40% during the past month.

Ankr has a great deal to offer investors. This blockchain network allows cloud-computing providers to offer underutilized resources to users requiring cloud infrastructure. Cloud-computing providers are rewarded in ANKR tokens as compensation.

Additionally, there are other great benefits users receive on the Ankr network. Let’s dive into why this is a top cryptocurrency on my watch list right now.Collapse

1. Ankr is changing the game

The cloud-computing world is relatively well-defined, and just a handful of large players dominate the market. With such an oligopolistic structure, pricing power resides mainly with cloud-computing providers. This is great for someone who owns Amazon stock, but not so great for companies or users requiring cloud infrastructure.

Ankr seeks to change all that. This network takes existing underutilized hardware from cloud-computing providers and rents it out. In exchange for ANKR tokens, cloud-computing companies can maximize the use of their computing power. Wastage is a big deal in every sector, and Ankr helps minimize this issue to a great extent.

The idea of maximizing underutilized assets happens to be a very eco-friendly endeavor. Of course, not all blockchains are environmentally progressive. Much has been made about how much energy Bitcoin consumes every year. (Hint: almost as much power as the entire country of Thailand.)

Ankr has found a way to create utility for end users. This blockchain network aims to do so by using what already exists, rather than adding to the energy-consumption problems plaguing this sector.

2. Ankr provides a decentralized service

Back to the decentralized piece of the equation. Decentralization is a buzz word in crypto for a reason. By cutting into the centralized market power of a few companies controlling any one sector, blockchain projects like Ankr aim to democratize pockets of the economy (and maybe the whole economy, one day).

At a high level, these goals sound idealistic and unattainable. However, the implications of Ankr’s cloud-computing potential are immense.

Most centralized cloud-computing services have a single or just a few points of failure if various central locations lose power. For decentralized cloud-computing players like Ankr, this risk is minimized. By using a decentralized network of providers, Ankr can offer network stability and relatively low-cost cloud-computing services to companies looking for decentralized options.

As demand for decentralized solutions increases, Ankr could see increased adoption drive the value of its network higher. Therefore, those banking on the value of ANKR tokens as representative of the value its ecosystem creates may consider ANKR an intriguing growth option.

After all, this is a network that’s looking to find novel solutions to modern problems. There’s a lot investors should like about that.

3. Ankr is bringing staking to a new level

Besides the cloud-computing angle (which I think is really something), Ankr also provides unique value in how investors stake tokens. Staking refers to putting up ones tokens or locking them into a given blockchain protocol to allow validation of transactions. People who stake their tokens typically receive interest in the form of additional tokens. Accordingly, this is a passive income opportunity many crypto investors are looking to get into.

However, Ankr provides an intriguing way for investors to stake tokens while putting up much smaller capital investments to do so. How?

Ankr’s StakeFi product lets investors put up as little as 0.5 Ether to earn staking rewards. Currently, 32 ETH are required to stake on Ethereum‘s ( ETH 0.86% ) beacon chain. This would require the equivalent of more than $125,000, at present.

The platform does this by utilizing synthetic derivatives to essentially limit the amount of initial capital investors need to put up. Similar to options in the stock market, Ankr is becoming a revolutionary force in this growing area of decentralized finance.

Sure, Ethereum is moving toward Ethereum 2.0, which is likely to streamline its staking process substantially. However, delays in the move to Ethereum 2.0 have persisted. For now, Ankr has an opportunity to expand its market share in this emerging DeFi category.

A network that adds real-world value

Cryptocurrency investing is inherently risky, and Ankr is no exception. This crypto network faces the same systemic risks and competitive environment as its peers.

However, Ankr is creating some real-world value with its network. The fact that companies can utilize Ankr’s protocol to maximize their return on assets while providing decentralized cloud-computing services to users is impressive. Additionally, I think there’s a lot to like about Ankr’s DeFi potential.

The ANKR token is one that represents a blockchain with a tremendous (and growing) value right now. Accordingly, I’m watching this is token closely.